Fixed income investments with returns above 100% of CDI and FGC guarantee: security or trap? What are the alternatives?

The promise of high yields in CDBs, LCI, LCA among other products that are guaranteed by the Credit Guarantee Fund (FGC), such as those that offer 130% of the CDI, accompanied by the famous guarantee of the FGC (Credit Guarantee Fund) may seem an unmissable opportunity. However, it is essential to understand the real risks behind this protection which, although useful, is not as solid as it seems.

The fragility of FGC

The FGC is a private entity financed by its own financial institutions, with the mission of protecting investors in case of bankruptcy of banks issuing products such as CDBs, LCIs, LCAs, among others as the current account balance. The coverage is limited to R$ 250,000 per CPF, by institution, including principal and interest.

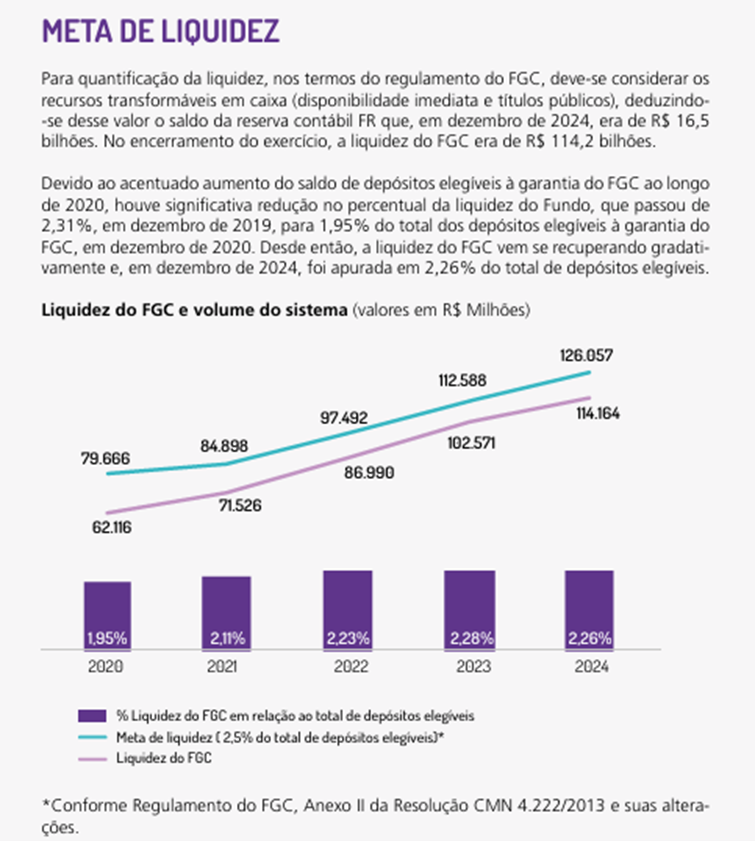

Source: FGC Annual Report (2024)

But there is a structural problem:

The cash value of FGC represents less than 3% of the total it promises to guarantee. In a real scenario, such as the intervention in the Master Bank in 2025, more than 64% of the fund’s liquidity would be consumed to cover a single bank, which was not even formally liquidated.

This shows that, in case of bankruptcy of a medium or large bank, the FGC may not have sufficient resources to indemnify all investors. Protection is therefore limited, fragile and exposed to systemic risk. Only the guarantee capital of Banco Itaú represents more than 500% of FGC, other large banks also have more than 100% on the capacity of FGC.

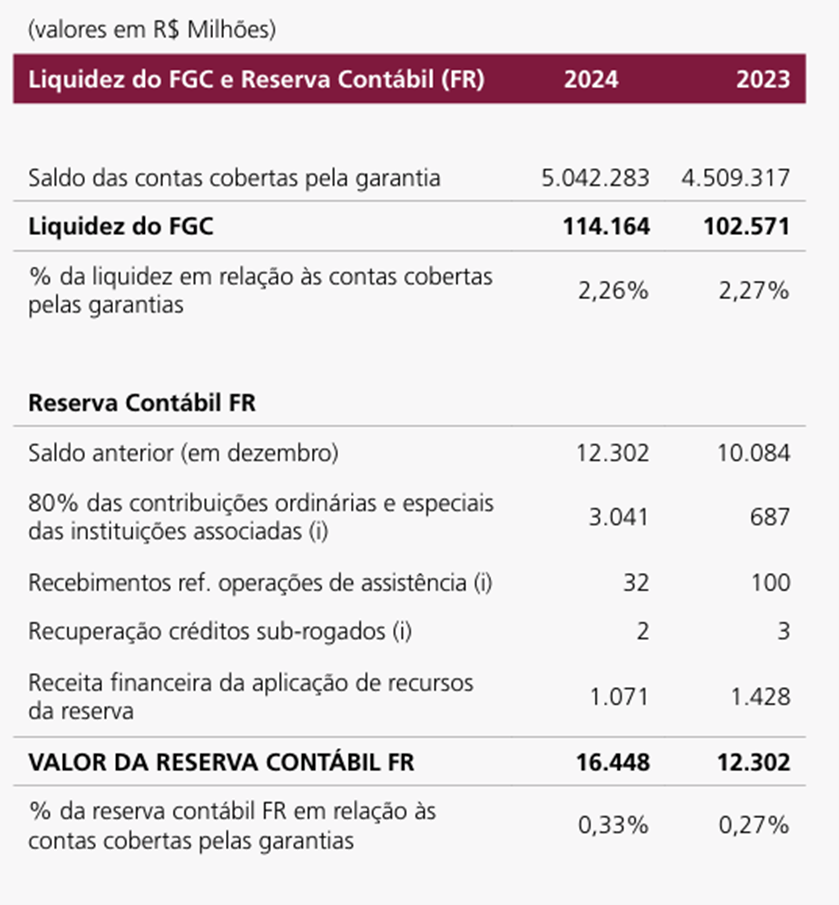

The total that FGC has liquidity for coverage is only R $ 114.16 billion reais, but the total risk, which is over the coverage of FGC is R $ 5.04 trillion reais, only 2.26% coverage.

Source: FGC Annual Report (2024)

FGC is useful, but not infallible

It is important to recognize that FGC is a valid tool, but its coverage capacity is far from absolute. In times of increasing issuance of CDBs by mid-market banks and fintechs, the overcharging of the fund is a real and growing risk.

The alternative: FIDCs with senior quotas

For investors looking for assets with good profitability and protection mechanisms, a more structured alternative is the FIDCs (Credit Rights Investment Funds), especially through senior quotas.

Why do FIDCs offer protection?

In a FIDC, the senior quotas have priority in receiving payments and rely on a protection called “subordination”, which functions as a security barrier. This means:

- Before the senior quota suffers any loss, the subordinate quotas absorb losses.

- The minimum subordination required by regulation is 10%, but many funds work with 20% or more of protective mattress and can be higher than 50%.

- Compared with FGC, which only covers about 2.26% of the total guaranteed liquidity, subordination in FIDCs is significantly attractive.

- In addition, FIDCs are regulated, audited, and structured with transparency on assets and risks, allowing the investor a more accurate analysis.

Invest with strategy, not just based on promises of high returns and apparent protection.

OKEAN ATLANTIC CORPORATE FIC FIM CP (CNPJ: 51.980.833/0001-05)

Okean Atlantic is a quota investment fund that offers access to a diversified portfolio of FIDCs (Credit Rights Investment Funds). More than 95% of its net worth is allocated to senior quotas of more than 10 different FIDCs, which ensures diversification, reducing concentration-related risks.

Main Advantages:

- Differentiated taxation: only 15% on the profit in the redemption, regardless of the application term, because it is characterized as an investment entity.

- Exemption from quota payments: as the fund is characterized as an investment entity, it is exempt from the semi-annual tax advance.

- Accessible contributions: initial investment from R$ 5,000.00.

- Diversification: by investing, you expose your capital to a carefully selected basket of FIDCs, reducing risks and expanding the return potential.

- Performance: The fund has been profitable every month above CDI, with an average profitability of 130% of CDI.

| PERFORMANCE | jun/24 | jul/24 | ago/24 | set/24 | out/24 | nov/24 | dez/24 | jan/25 | fev/25 | mar/25 | abr/25 | mai/25 | ANO | 12 MESES | DESDE INÍCIO |

| OKEAN ATLANTIC CORPORATE FIC FIM |

1,11% | 1,31% | 1,21% | 1,13% | 1,38% | 0,97% | 1,12% | 1,34% | 1,30% | 1,26% | 1,37% | 1,36% | 6,81% | 15,91% | 28,10% |

| CDI | 0,79% | 0,91% | 0,87% | 0,84% | 0,93% | 0,79% | 0,93% | 1,01% | 0,99% | 0,96% | 1,06% | 1,14% | 5,26% | 11,80% | 21,19% |

| RENTABILIDADE ACUMULADA | 141% | 144% | 139% | 136% | 148% | 122% | 120% | 132% | 132% | 130% | 129% | 119% | 129% | 134% | 132% |

How to invest:

You can access more information about the fund, including foil, regulation and informational materials, on the official website: www.okeaninvest.com, and distributed by Azumi DTVM.

Before investing, it is essential that you carefully read the blade and fund regulation. Evaluate whether the product is suitable for your investor profile.

In case of doubts, consult a professional duly qualified to guide you in your investment decision.