Credit Rights Investment Funds (FIDCs) have reached a historic milestone by surpassing, for the first time, equity-based equity funds, standing out as an increasingly attractive alternative in the current financial scenario. In 2024, the net worth of FIDCs reached an impressive R$ 589 billion, a robust growth of 32.6% compared to the previous year. The equity funds, in a context of contraction of the equity market, showed a fall of 6.9%, totaling R$ 584 billion.

This move reflects a significant shift in the allocation of investors’ resources, who are moving away from higher risk assets such as equities and moving to private credit options with a more stable return outlook. In an economic environment of high interest rates, where traditional fixed income options such as debentures offer more compressed returns, FIDCs stand out as a promising alternative for those seeking profitability in a controlled risk scenario.

FIDCs, which invest in receivables from companies such as duplicates, checks and financings, have attracted investors due to their flexibility and potential for return. These funds allow companies to anticipate their receivables, providing immediate liquidity, while investors benefit from buying those rights at discounted prices. In addition, the FIDCs offer a diverse structure, with senior and subordinate quotas, serving different risk and return profiles.

The growth of this asset class is not only a reflection of the macroeconomic situation, but also of a structural change in the financial market. The migration of traditional bank credit to the capital market has boosted the supply and demand for these funds. With more favorable regulations and the emergence of new opportunities, such as the possibility for FIDCs to buy shares from other FIDCs, the market has become more dynamic and attractive.

Tax advantages are on the rise among investors

One of the attractive advantages of Credit Rights Investment Funds (FIDCs) is the tax benefit they offer, which has become a crucial factor for many investors when considering their resource allocation options. This benefit is mainly related to the favorable tax treatment that FIDCs receive in comparison with other types of investment funds.

The main tax advantage of FIDCs is the exemption from “quota-grabbing”, a tax withheld every six months on the income of certain investment funds. For traditional fixed income and multi-market funds, the “quota-eating” rule implies a six-monthly tax rate of 15% to 20%, which reduces the net investor’s returns over time. This type of tax is applied regardless of whether the investor carries out or not the redemption of its quotas. The FIDCs, in turn, are not subject to this six-monthly charge, which provides a significant advantage in terms of net profitability, especially for long-term investors.

In addition, the taxation of FIDCs occurs only at the time of quota redemption, with a rate of 15% on capital gain. This form of taxation allows investors to keep the income within the fund, generating more profitability over time, before the tax incidence occurs. This tax deferral can be highly advantageous for those seeking a more robust growth of their capital, without the need to pay taxes before carrying out the rescue.

In 2024, the fundraising by the FIDCs reached the mark of R$ 113 billion, almost three times the volume raised in the previous year. This phenomenon was driven not only by the search for credit alternatives in a context of high interest rates, but also by the growing adherence of individual investors, whose participation accounts in FIDCs doubled throughout the year.

Favorable winds with CVM 175 Resolution

The change in regulations, such as CVM Resolution 175, also contributed to strengthening FIDCs by simplifying the governance structure and increasing transparency of funds. This new regulatory framework increases investor confidence, while also expanding opportunities for management and innovation within the industry. The possibility of incorporating ESG criteria and other more sophisticated strategies has attracted investors who seek sustainable and well-structured alternatives.

The growth of FIDCs reflects an intelligent adaptation by investors to a scenario of greater complexity and the search for profitability in an environment of high interest rates. These funds, which are still relatively new in the portfolio of many Brazilians, have demonstrated a significant potential for investment diversification and for the search for more predictable and controlled returns, at the same time as positioning themselves as a viable solution for financing companies in a challenging economic scenario.

Get to know the fund OKEAN ATLANTIC CORPORATE FIC FIM CP

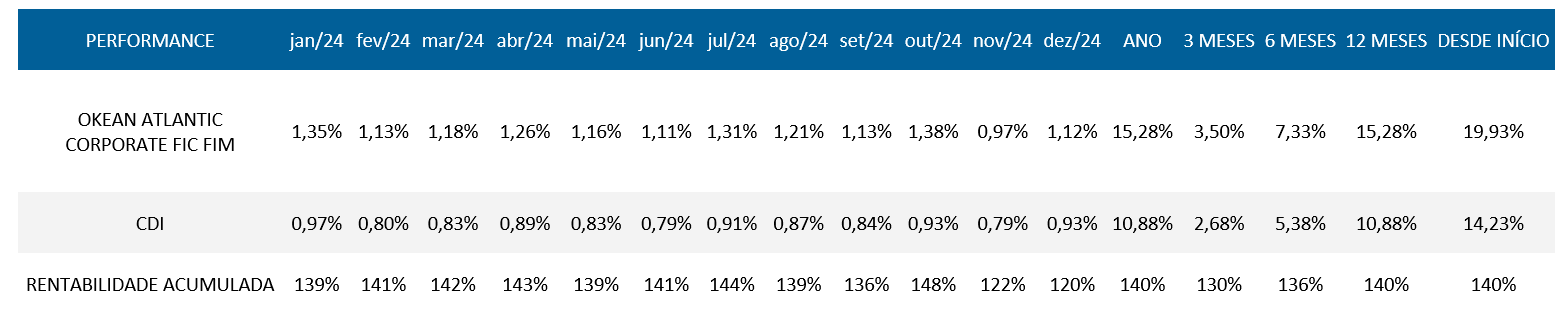

The fund OKEAN ATLANTIC CORPORATE FIC FIM CP invests more than 95% of its net worth in various shares of FIDCs, being an investment fund in shares of other funds, focused on the private credit segment diversifying into 12 different funds.

The OKEAN ATLANTIC CORPORATE FIC FIM CP fund is a fund that has been bringing consistency, low volatility and returns above traditional fixed income, it is an option for diversification of the investment portfolio.

It is a fund with a low value to start the investment, only R$ 5000.00. One of the biggest differentials of this fund is the tax burden, only 15% on the profitability at the time of the rescue, regardless of the time in which the resource was invested, thanks to a tax benefit for FIDCs and funds that invest only in them. OKEAN ATLANTIC CORPORATE FIC FIM CP is a fund intended only for investors characterized as qualified.

For more information access the site https://okeaninvest.com, in case of doubts, you can contact us by our website or e-mail contato@okeaninvest.com and also phone (11) 5990-3694.

Remember before investing read the blade and regulation carefully, as all investment, there are risks, not being this fund risk-free, understand what are the risks of investments linked to private credit and FIDCs. Okean Invest does not guarantee or promise any kind of profitability, if you have any questions please contact us or a certified professional.