Low performance expectations for the Ibovespa in 2025, make investments in fixed income and private credit gain prominence!

Itaú projects Selic’s high to 15.75% per year in 2025

The economic scenario of 2025 in Brazil remains challenging, with the financial market dealing with the prospect of high interest rates and rising inflation, which has generated a more restrictive monetary policy. Financial institutions such as Itaú adjusted their projections, raising the estimate of the Selic rate to 15.75% by the end of 2025, an increase over the previous forecast of 15%. This is due to the deterioration of inflation expectations and the recent devaluation of the real, which requires a stronger adjustment in interest rates by the Central Bank.

With a high Selic and no cuts expected until 2026, fixed income investments and private credit become more attractive. These assets offer superior profitability and more security compared to the stock market, which continues to face volatility. The Credit Rights Investment Funds (FIDCs) have been an excellent alternative, since this segment has shown considerable growth in Brazil. Driven by the need for companies to finance their working capital, FIDCs are a great option for those seeking moderate risk profitability, especially in a high interest rate scenario.

Bank of America survey points to discouragement for the Ibovespa Index

Meanwhile, the Bovespa (Ibovespa) Index continues to face an uncertain scenario. According to the latest Bank of America survey, fund managers’ sentiment towards the index is dismal, with expectations for limited performance for the year. The projections for the Ibovespa range between 110,000 and 140,000 points, with the index currently at 122,000 points. Only 9% of managers believe the index will reach 140,000 points by the end of the year, a significant drop from the 17% who believed this in the previous survey. This dispersion reflects the market’s caution, especially in the face of external factors such as high interest rates in the United States and a stronger dollar, which remain risks for the Latin American economy.

Favorable scenario for investments in fixed income and private credit

The high interest rate scenario also impacts the stock market, with investors being more defensive. The financial sector remains the most allocated among managers in the region, while sectors such as discretionary consumption and durable goods are avoided. With cash levels of funds rising and risk levels declining, caution is up, reflecting the difficulties in anticipating a robust recovery for the stock market this year.

In an environment of high interest rates and a stock market with low growth expectations, the strategy of allocation to fixed income and private credit becomes increasingly relevant. FIDCs, in particular, represent a valuable opportunity for investors seeking to maximize their returns while mitigating the risks of a more challenging global economic landscape. At the same time, the feeling of discouragement towards Ibovespa suggests that the stock market may face additional difficulties in 2025, making fixed income and private credit options even more attractive at this point.

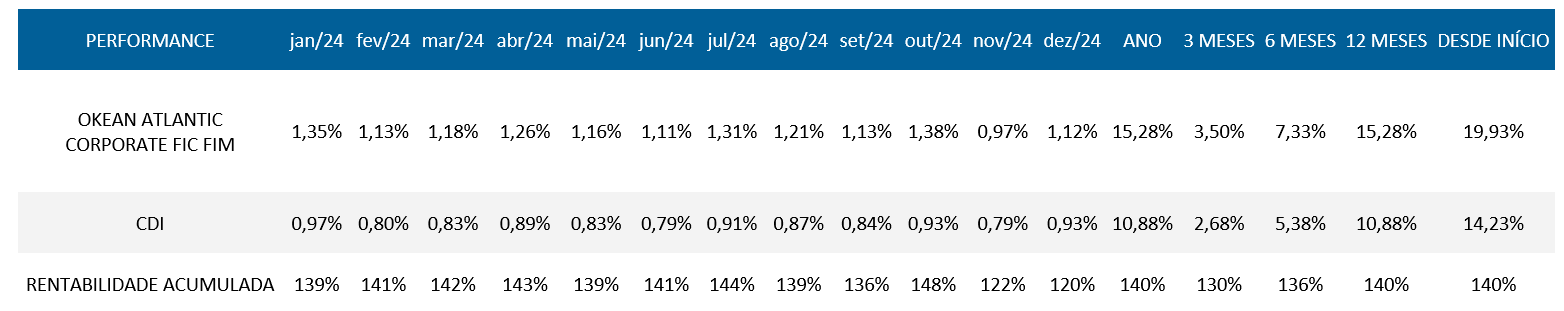

Get to know the fund OKEAN ATLANTIC CORPORATE FIC FIM CP

The OKEAN ATLANTIC CORPORATE FIC FIM CP fund invests more than 95% of its liquid assets in various shares of FIDCs, being an investment fund in shares of other funds, focused on the private credit segment diversifying into 12 different funds.

The OKEAN ATLANTIC CORPORATE FIC FIM CP fund is a fund that has been bringing consistency, low volatility and returns above traditional fixed income, it is an option for diversification of the investment portfolio.

It is a fund with a low value to start the investment, only R$ 5000.00. One of the biggest differentials of this fund is the tax burden, only 15% on the profitability at the time of the rescue, regardless of the time in which the resource was invested, thanks to a tax benefit for FIDCs and funds that only invest in them. OKEAN ATLANTIC CORPORATE FIC FIM CP is a fund intended only for investors characterized as qualified.

For more information access the site https://okeaninvest.com , in case of doubts, you can contact us by our website or e-mail contato@okeaninvest.com and also phone (11) 5990-3694.