The Copom has already signaled that in the next two meetings there will be a 1% increase in the Selic rate per meeting, which will bring the rate to 14.25% in the first half of this year. Considering the history of 2024 and the direction of public policy in Brazil, we at Okean Invest project that Selic can reach, and even surpass, the barrier of 15% per year due to the inflationary uncontrolled that has characterized the Brazilian economy.

It is not a reason to be scared or sad, enjoy and invest!

Although high interest rates are not favorable to economic growth, they are essential for controlling inflation. Its main function is to stabilize the prices of products and services, reducing consumption by making credit more expensive and decreasing the amount of resources circulating in the economy. In a high Selic rate scenario, it is essential to know how to take advantage of the situation, exploring the opportunities that arise. Even in difficult times, it is possible to take advantage of this high, making your money yield more, through investments in private credit funds.

Why invest in private credit funds?

Private credit funds have gained popularity among investors, especially in a high-interest economic scenario and looking for alternatives that offer more attractive returns than traditional fixed income investments. If you are thinking of diversifying your portfolio or improving your earnings, investing in private credit funds can be an excellent choice. Here are the main reasons why these funds deserve your attention.

What are Private Credit funds?

Private credit funds are those that invest in debt securities issued by private companies or financial institutions, rather than public bonds. These securities can be indexed to the CDI, inflation or even other indices, offering investors a higher return than traditional fixed income investments such as CDBs or Treasury Bills.

By investing in these funds, the investor has access to a diverse range of assets such as debentures, certificates of receivable, and other credit instruments issued by companies and even shares of FIDCs (Fund for Investment in Creditor Law), which have an above-average return and low volatility. This allows not only greater diversification, but also the possibility of achieving higher returns, since the credit risk of these operations is usually higher than that of government bonds, offset by a higher profitability.

Attractive profitability

One of the biggest advantages of private credit funds is the possibility to generate returns higher than CDI. While traditional fixed-income investments, such as Selic Treasury, can offer lower returns compared to the high interest rates, private credit funds have the potential to outperform these indices. In times of high interest rates, such as the current double-digit Selic scenario, private credit funds stand out for offering a more attractive return, with risks that can be controlled through diversification.

These funds are structured to invest in a basket of credit bonds, which dilutes the risk of default of any individual issuer. In addition, often these funds are composed of inflation-indexed assets, which can protect the investor’s purchasing power against rising prices.

Portfolio diversification

Diversification is a key principle to reduce risks in any investment portfolio. Private credit funds offer a simple and efficient way to diversify your investments, as these funds are composed of a variety of debt securities issued by different issuers and sectors of the economy. This helps to reduce exposure to a single asset or segment and protect the portfolio from market fluctuations that may affect only one type of security.

In addition, these funds may have an allocation to various types of private credit such as debentures, real estate receivables, and other financing instruments, increasing the chance of consistent gains even in volatility scenarios.

Potential for improvement

Private credit funds have significant potential for appreciation, especially in favorable economic environments, such as a cycle of high rates in the Selic rate. When the interest rate rises, the yield on the debt tends to increase, which can result in a higher return for investors in these funds. The increase in Selic also makes the credit market more attractive for companies, which seek to raise capital through debt issues, which creates new opportunities for credit funds.

In addition, as these funds buy assets with different maturities and risk characteristics, the valuation of the papers can be influenced by macroeconomic factors such as inflation and interest rate, as for factors specific to the companies or sectors in which the assets are inserted.

Legal and regulatory certainty

In recent years, there has been an improvement in the regulation and legal certainty of private credit funds. The creation of clear rules, such as Resolution 175 of the Securities and Exchange Commission (CVM), brought greater transparency and protection for investors. This has made many credit funds more attractive, as they provide greater confidence in the management of resources and the quality of the assets in which they invest. The funds have professional administration and management, custodian, audit and often with specialized consultants, in addition to the supervision of CVM and ANBIMA on the funds and institutions participating in the capital market.

Less volatility than equity funds

Unlike equity or multi-market funds, which can be quite volatile and susceptible to fluctuations in the variable-income market, private credit funds offer greater stability in the long term. Although credit risk exists, it can be reduced through careful portfolio analysis and asset diversification. Private credit funds also tend to be less impacted by immediate economic crises, as assets are more conservative in nature, with a focus on fixed income.

Accessibility and ease of investment

Investing in private credit may seem complicated for those who seek to make direct investments in debentures or other debt securities. However, private credit funds allow the investor to have access to this market in a practical and accessible way. They offer the asset diversification and professionalism of an experienced management team, without the need to directly engage in the analysis and purchase of securities.

In addition, private credit funds are available in various modalities, which cater from beginner to more experienced investors. From relatively low initial contributions, it is possible to invest and take advantage of the benefits of this class of assets.

Get to know the fund OKEAN ATLANTIC CORPORATE FIC FIM CP

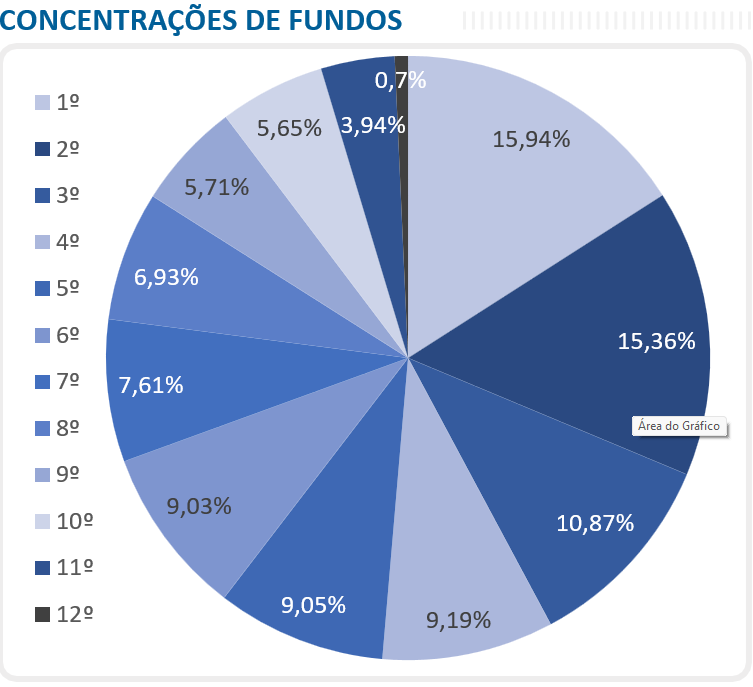

The OKEAN ATLANTIC CORPORATE FIC FIM CP fund invests more than 95% of its net worth in various shares of FIDCs, being an investment fund in shares of other funds, focused on the private credit segment diversifying into 12 different funds.

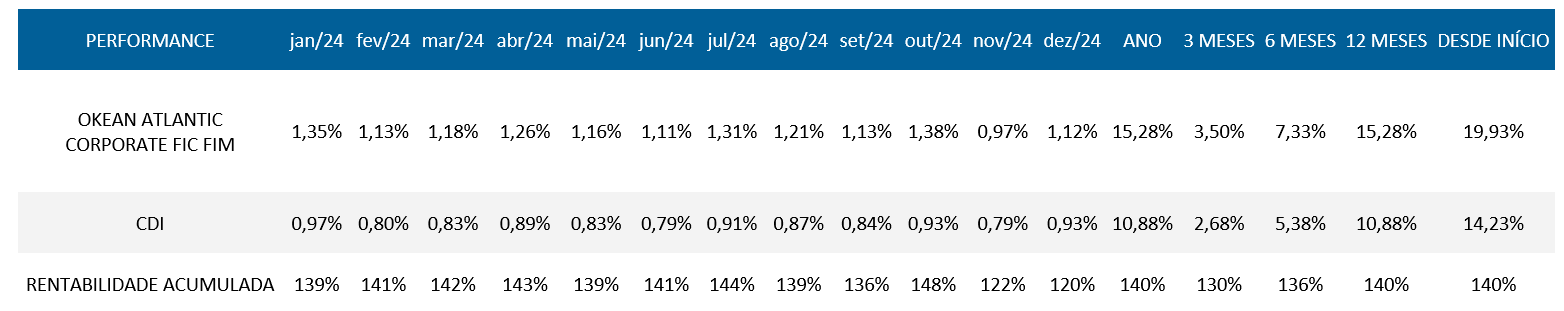

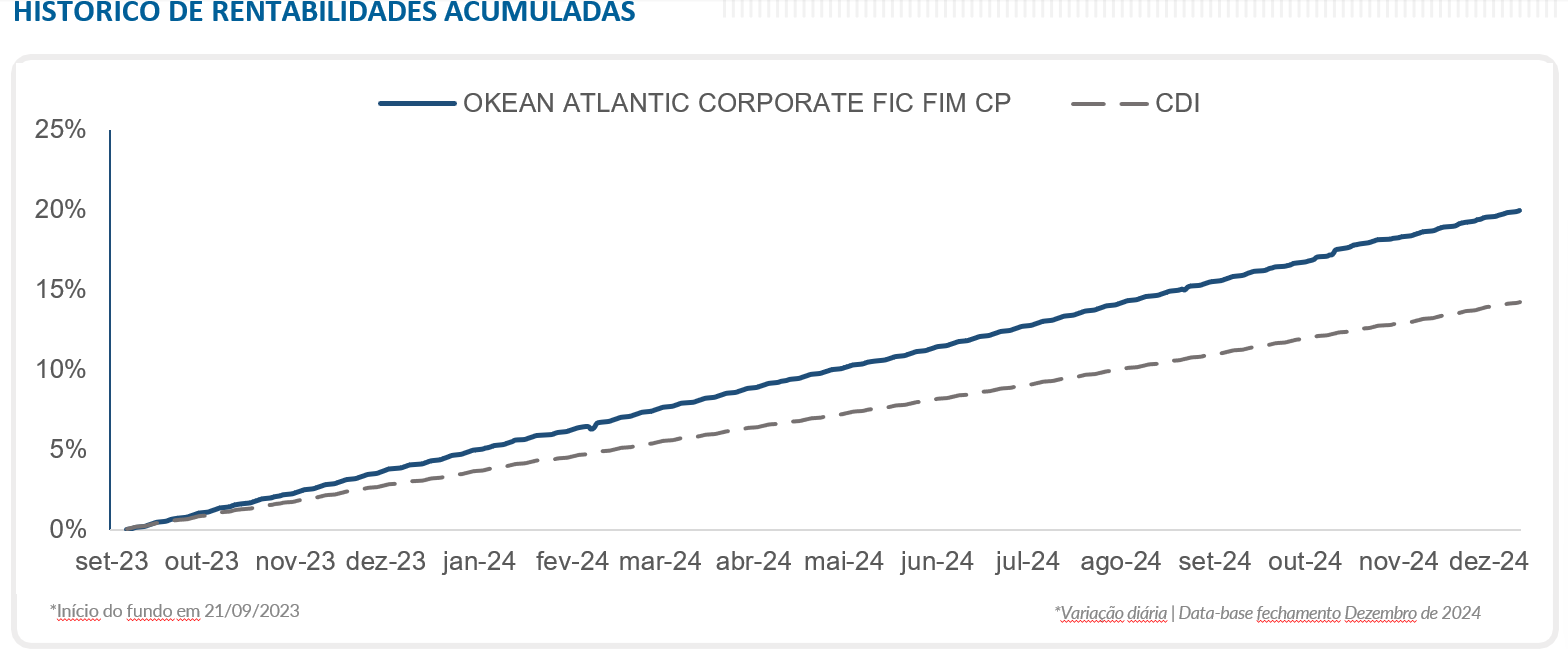

In 2024, the fund achieved a return of 15.28%, reaching the 140% mark of CDI in the year. During the whole year, the fund closed every month with a positive result and maintained a constant growth, confirming the potential and solidity of the strategy to invest in the senior quotas of FIDCs.

The OKEAN ATLANTIC CORPORATE FIC FIM CP is a fund that has been bringing consistency, low volatility and returns above the traditional fixed income, it is an option for diversification of the investment portfolio.

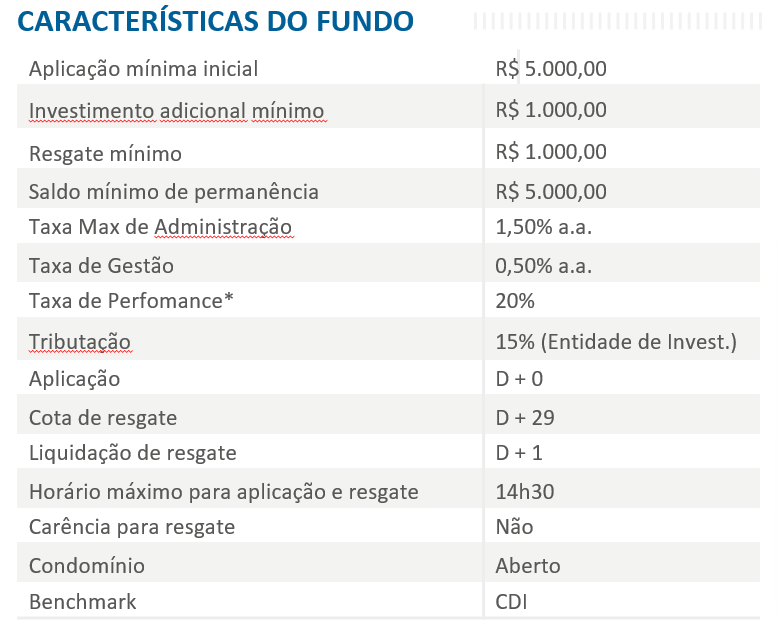

It is a fund with a low value to start the investment, only R$ 5000.00. One of the biggest differentials of this fund is the tax burden, only 15% on the profitability at the time of the rescue, regardless of the time in which the resource was invested, thanks to a tax benefit granted to FIDCs and funds that invest only in them.

OKEAN ATLANTIC CORPORATE FIC FIM CP is a fund intended only for investors characterized as qualified.

For more information access the site https://okeaninvest.com/ , in case of doubts, you can contact us by our website or e-mail contato@okeaninvest.com and also phone (11) 5990-3694.

Remember before investing read the blade and regulation carefully, as all investment, there are risks, not being this fund risk-free, understand what are the risks of investments linked to private credit and FIDCs. Okean Invest does not guarantee or promise any kind of profitability, if you have any doubts please contact us or a certified professional.